At SHUAA we are committed to being at the forefront of the latest market trends and providing innovative investment solutions for our clients and stakeholders.

As part of our leading Private Debt practice in the region with over $545M invested, we have collaborated with MAGNiTT and published the 2022 MENA Venture Debt Investment Report.

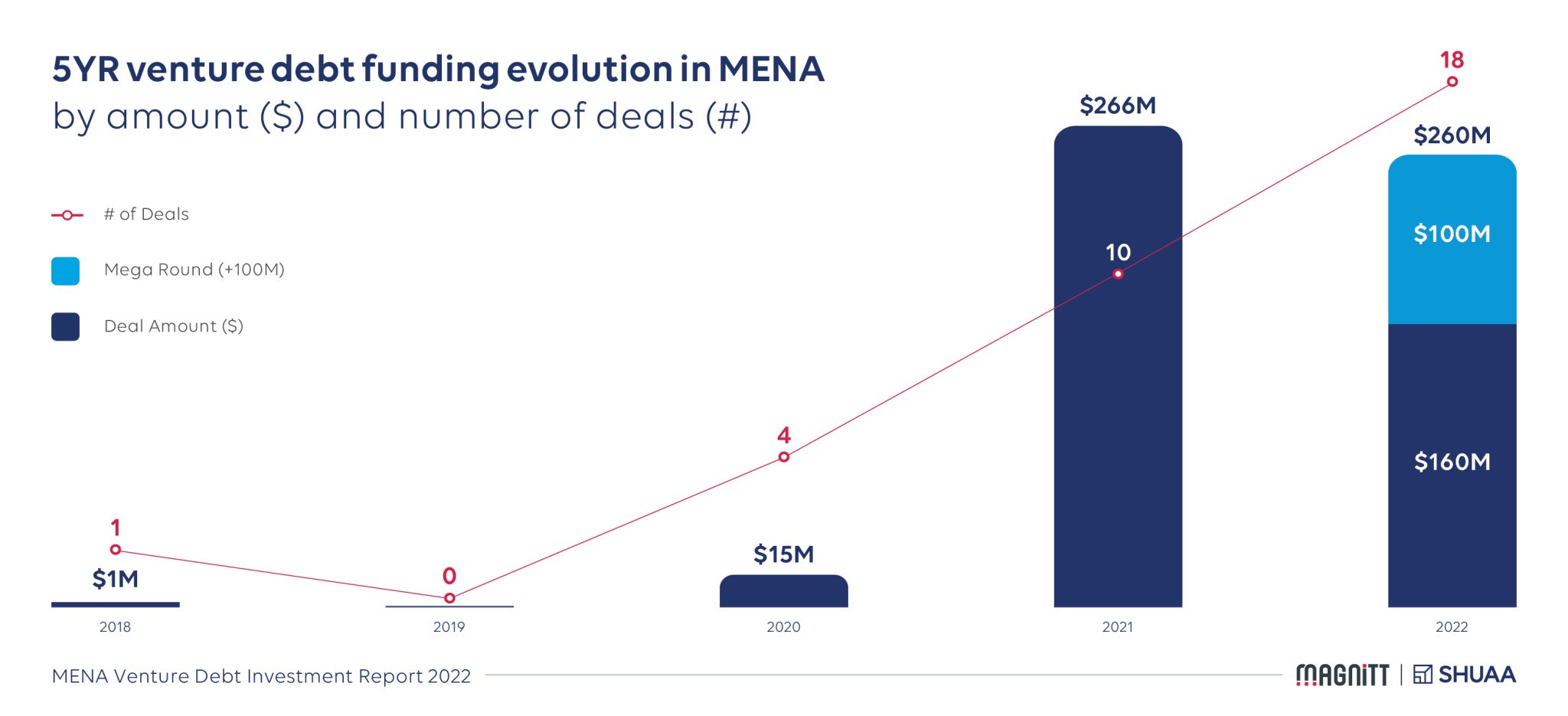

The role of venture debt has been growing in the MENA region over the past five years, with 2021 reporting a record-high funding total. The 18x rise in venture debt funding between 2020 and 2021 highlighted its elevated position as a strategic tool to support startup growth.

Venture debt deals almost doubled between 2021 and 2022, despite total investment in 2022 falling $6M short of the funding in 2021. Venture debt aggregated $260M across 18 deals in 2022, a year that saw the first mega-deal for venture debt in the MENA region. The deal was closed by UAE-based FinTech startup Tabby and contributed 39% to the total venture debt funding reported in 2022.

The report maps the evolution of venture debt funding and activity in the Middle East and North Africa (MENA) region over the past five years by target countries, industries and investors.

To that avail, the rise in the number of deals accompanied by a drop in funding pushed the average transaction size down from $26.6M in 2021 to $14.4M in 2022.

Venture debt funding was concentrated in four countries of the MENA region, namely UAE, KSA, Egypt and Jordan. UAE-based startups were the MENA leaders in the number and value of venture debt deals closed, as they took over half the number of deals and value of funding reported for the MENA region between 2018 and 2022.

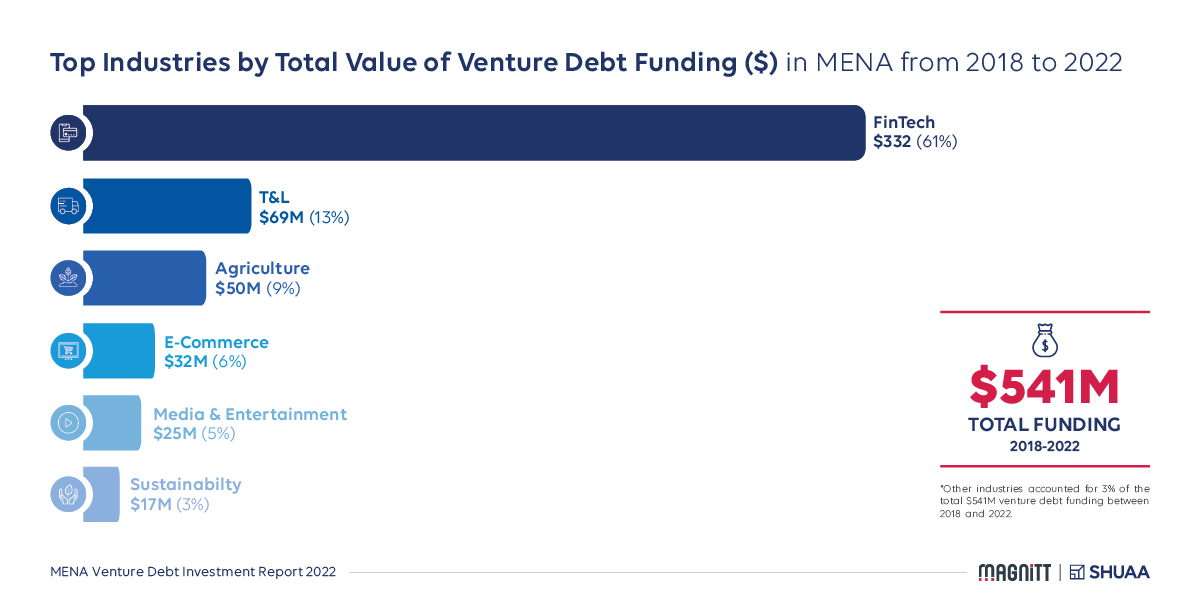

Mirroring the venture capital trend in the MENA region, FinTech captured the highest share of venture debt deals between 2018 and 2022 by number of deals raising 61% of total venture debt funding over the same period. While FinTech, Transport & Logistics and E-Commerce remain industries of choice, Agriculture landed in the top three following $50M venture debt deal closed by Pure Harvest Smart Farms and to which SHUAA Capital and Shorooq Partners were investors.

With the rising interest in venture debt funding in 2021 and 2022, the number of investors reached 26.The share of international (Non-MENA) investors rose from 20% in 2021 to 47% in 2022, reflecting the rising international interest in venture debt as a financing tool for the region.

What’s In The Report?

This report provides a comprehensive overview and deep dive into the MENA region’s venture debt investment space and includes the following:

- A 5-year analysis of the MENA region’s venture debt funding evolution

- MENA country comparison by venture debt funding and deals

- Industry comparison by venture debt funding and deals

- Active investors by number of investments

- Top 5 startup venture debt funding rounds between 2018 and 2022